Interest rates are super low – so what’s today’s “interest rate”?

By Don | September 30, 2011

Being in the business, we get this question from time to time – and it’s impossible to answer in a sound bite! The short answer is that there are too many variables for a quick number like 4%.

Being in the business, we get this question from time to time – and it’s impossible to answer in a sound bite! The short answer is that there are too many variables for a quick number like 4%.

What kind of loan? Conventional, FHA? What’s the loan to value (LTV)? What’s your credit score? Do you want an interest rate lock? For how long? How much is the loan? Over the $417k conforming limit? What’s your back end ratio (debt to income ratio)?

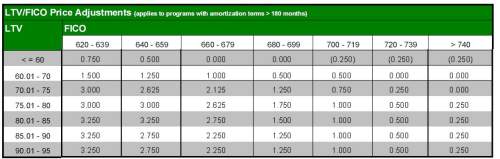

Let’s take a look at a recent matrix to see how, with conventional financing, variations in FICO scores and loan to value (LTV) amounts affect interest rates…

(Click on the matrix for a bigger chart)

(Click on the matrix for a bigger chart)

Let’s assume the base interest rate is 4%. Also assume you’re coming in with a 25% down payment for a LTV of 75%. You’d think that with a big down payment you’d get that 4% rate – but your FICO score is 625. Looking at the matrix, you see you’d have to add a whopping 3% adjustment to that 4% for an interest rate of 7%. Ouch!

But let’s say your FICO is 750 and you can come up with just over 5% down payment. Now your adjustment is only 0.25% – not bad!

Looking at the matrix with your 750 score, you’d also notice that coming in with a bigger down payment doesn’t pay off in a lower interest rate until you hit more than a 25% down payment. You can keep that extra cash – but beware of the potential for mortgage insurance if you have less than a 20% down payment.

You can also pay “points” to bring down your interest rate if you’re really sure you’re going to be in your home for a long duration.

So how do we answer the question of what’s today’s interest rate? We say they’re at generational lows, around 4% or maybe even better!